How to Educate Yourself on Different Coverage Types

Understanding your insurance coverage is essential for safeguarding your assets and achieving peace of mind.

With a myriad of coverage options at your disposal ranging from auto and health to homeowners and life insurance the choices can feel daunting.

This article will meticulously break down the various types of insurance, illuminate their significance, and provide you with practical tips to select the right coverage tailored to your needs.

Empower yourself with the right knowledge!

Contents

- Key Takeaways:

- The Importance of Understanding Coverage Types

- Types of Insurance Coverage

- How to Choose the Right Coverage for You

- Tips for Educating Yourself on Coverage Types

- Frequently Asked Questions

- Why is it important to understand life insurance coverage?

- What is liability insurance and why should I learn about it?

Key Takeaways:

- Understanding different coverage types is crucial for protecting yourself and your assets in case of unforeseen events.

- Auto, health, homeowners, and life insurance are all important types of coverage to consider for different aspects of your life.

- Assess your specific needs and compare coverage options to find the right fit for your unique situation.

The Importance of Understanding Coverage Types

Understanding the various types of insurance coverage is essential for securing the right financial protection and making smart choices about coverage to safeguard against potential risks.

Whether it s auto insurance, health insurance, homeowners insurance, or life insurance, familiarizing yourself with the details of these policies can help you avoid money problems and strengthen your risk management strategies.

Taking time to educate yourself empowers you to make informed choices about how to identify your coverage needs and select insurance products that fit your situation.

Why Knowing Your Coverage Matters

Understanding your coverage is essential, as it directly influences your personal liability and financial security in unexpected situations, highlighting the importance of knowledgeable coverage choices.

When you re not fully informed about your insurance options, you risk experiencing significant financial losses during unforeseen events. A solid grasp of the various policies available prepares you for potential limitations and exclusions, ultimately protecting you from being vulnerable.

This shows how crucial it is to educate yourself and explore diverse educational resources, empowering you to make informed decisions as a policyholder. For example, tips for understanding complex coverage terms can aid you in navigating these complexities, allowing you to protect your financial well-being and enhance your awareness of the liabilities you may encounter in challenging times.

Types of Insurance Coverage

You have access to a range of insurance coverage options, each designed to fulfill a specific need and tackle the unique risks that come with everyday life and property ownership.

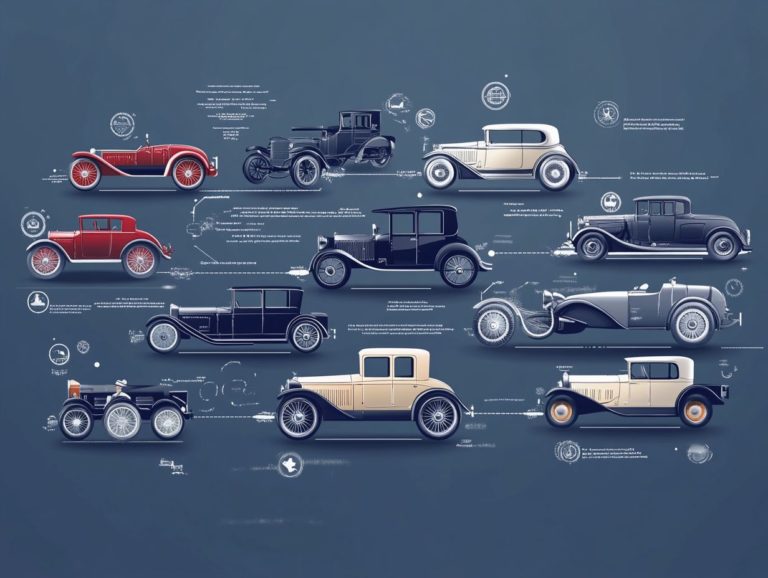

Auto Insurance

Auto insurance plays a crucial role in achieving financial security by offering coverage for your vehicles and helping to mitigate the risks tied to accidents and theft.

It includes various types of protection, with liability coverage being essential for safeguarding yourself against claims from others in the event of an accident.

Comprehensive coverage provides peace of mind by addressing damages resulting from non-collision incidents, such as theft or natural disasters. Grasping the details of these options can profoundly influence how you manage your risk exposure.

Staying on top of premium payments is vital, as it ensures uninterrupted coverage and fosters responsible financial habits. This proactive approach ultimately benefits you when unexpected claims arise, allowing you to navigate challenges with confidence.

Explore your options and consider consulting an expert for personalized advice!

Health Insurance

Health insurance serves as your safeguard against high medical costs, ensuring you have access to essential healthcare services that are crucial for your overall well-being.

Choosing the right health insurance policy is vital for your financial stability. Options range from employer-sponsored plans to government programs like Medicare and Medicaid, each catering to different needs.

Be mindful of coverage limits, which refer to the maximum amount your insurance will pay for certain services. These limits can significantly influence the effectiveness of your plan, determining which medical expenses are covered and to what extent.

The rates for these insurance products are shaped by factors such as your age, health status, and geographical location. It s imperative for you to evaluate your unique circumstances.

By learning about your options, you can make more informed decisions, ultimately paving the way for enhanced financial security during uncertain times.

Homeowners Insurance

Homeowners insurance is your essential shield, providing invaluable protection for your property and possessions while safeguarding you against financial losses from damages or theft.

This type of insurance protects your house and your belongings. It ensures you re able to rebuild in the face of disaster and offers personal liability coverage to protect you from lawsuits or claims arising due to accidents or injuries occurring on your property.

Various policies often extend coverage to the belongings within your home, ensuring that your personal items are protected from unforeseen circumstances like fire, vandalism, or natural disasters.

You have the flexibility to customize your policy to meet your specific needs, making homeowners insurance a crucial aspect of smart financial planning.

Life Insurance

Life insurance is crucial for protecting your loved ones from unexpected expenses when you re gone. It provides peace of mind, knowing their future is secure.

Understanding the different types of policies whether term or whole life insurance gives you the power to make informed decisions tailored to your unique circumstances. By grasping the factors that influence insurance premiums, such as age, health, and coverage amount, you can select a plan that truly aligns with your financial situation.

Navigating the intricacies of insurance requirements is crucial for shielding your family from potential financial burdens. By recognizing the importance of these elements, you can craft a comprehensive strategy that not only protects your loved ones’ future but also enhances your overall financial security.

How to Choose the Right Coverage for You

Selecting the right coverage necessitates a thoughtful evaluation of your specific needs, alongside a meticulous comparison of the diverse coverage options available in the insurance market.

Assessing Your Needs

Assessing your insurance needs requires a careful examination of your personal financial situation, lifestyle, and potential risks to determine the coverage that best suits you.

Consider various factors such as your age, health, and family dynamics, as these elements significantly influence the type and amount of insurance you ll need. Understanding the specifics of each policy including exclusions and limitations can greatly affect the effectiveness of your protection.

Risk management should also be a crucial part of this evaluation; by identifying your vulnerabilities, you can prioritize which areas need stronger coverage.

Empowering yourself through self-education allows you to navigate this complex landscape with confidence. By researching different types of insurance and understanding the differences in policy coverage, and seeking advice from knowledgeable professionals, you can make well-informed decisions that are tailored to your unique circumstances.

Comparing Coverage Options

Comparing coverage options empowers you to find the insurance policies that perfectly align with your specific needs while securing the best available rates.

Taking the time to analyze different offerings is essential for identifying features that resonate with your personal circumstances and preferences.

By gathering comprehensive information on policy benefits, exclusions, and premium costs, you can make informed comparisons that truly matter.

Utilize online tools and resources, like comparison websites, to streamline this process. They grant you quick access to a multitude of options. Engage with agents who can clarify policy details and provide tailored insights to enhance your understanding.

Always consider both price and protection to secure the best coverage for your needs!

Tips for Educating Yourself on Coverage Types

Educating yourself about different coverage types is crucial for grasping the details of insurance. Learning how to make sense of your coverage options empowers you to make informed decisions that align with your financial goals.

Utilizing Online Resources

Utilizing online resources like blogs, TED talks, and audiobooks can significantly enhance your understanding of insurance coverage and related topics.

For example, reputable blogs such as The Insurance Information Institute and NerdWallet provide in-depth articles that break down complex concepts into easily digestible pieces.

TED talks from experts like John W. S. K. Hall underscore the importance of effectively navigating insurance landscapes and offer invaluable insights.

Audiobooks available on platforms like Audible feature titles that cover various insurance subjects, allowing you to engage in flexible learning wherever you are.

By exploring these diverse formats, you can cultivate a more comprehensive knowledge base in the ever-evolving world of insurance.

Consulting with an Insurance Agent

Consulting with an insurance agent is a smart move to gain insights into various insurance products and customize coverage to fit your specific needs.

These professionals offer a wealth of knowledge about different policies, making it easier for you to navigate the often complex insurance landscape.

By collaborating closely with an agent, you can uncover essential details that might otherwise slip through the cracks like discounts and coverage options that align perfectly with your personal circumstances.

This tailored approach not only empowers you to make informed decisions but also fosters a long-term relationship focused on adapting your coverage as your life evolves.

Frequently Asked Questions

What are the different types of coverage I should educate myself on?

The main coverage types you should educate yourself on include health insurance, auto insurance, home insurance, life insurance, disability insurance, and how to make informed decisions on coverage.

How can I learn about health insurance coverage?

You can educate yourself on health insurance coverage by researching different plans, understanding coverage terms, and comparing costs and benefits.

What should I know about auto insurance coverage?

When educating yourself on auto insurance coverage, it’s important to understand the different types of coverage available, such as liability, collision, and comprehensive, as well as how to understand your insurance policy coverage and how they protect you in different situations.

What does home insurance coverage typically include?

Home insurance coverage typically includes protection for your home’s structure, personal belongings, and liability for injuries or damages that occur on your property.

Why is it important to understand life insurance coverage?

Understanding life insurance is vital for protecting your loved ones financially if something happens to you.

There are different types of life insurance, like term life, which covers you for a specific period, and whole life, which lasts your entire life and can build cash value. Each has unique coverage and costs.

What is liability insurance and why should I learn about it?

Liability insurance safeguards you if you’re held responsible for harming someone or damaging their property.

Knowing about this coverage is crucial to protect yourself and your assets.