Auto Insurance Claim Timeline Explained

Navigating the world of auto insurance claims can feel overwhelming, especially after an accident when emotions run high.

Understanding the claims process is crucial to ensuring you receive the compensation you deserve. This guide is your key to mastering the auto insurance claims process, covering various types, the timeline from filing to resolution, and factors that can influence your claim.

You ll find valuable tips that help you streamline the process and engage effectively with your insurance company. Whether you’re a seasoned driver or just starting your journey on the road, this information will empower you to approach your auto insurance claim with confidence and clarity.

Contents

Key Takeaways:

- The timeline for auto insurance claims can change based on several factors, but it generally includes steps such as filing the claim, investigation, settlement negotiations, and final resolution.

- Factors affecting the length of the claim process include the type and severity of damage, insurance company processes, and any legal disputes.

- To ensure a smooth claim process, document the accident and damages accurately and communicate effectively with your insurance company.

Get to Know Your Auto Insurance Claims

Understanding auto insurance claims is crucial for you as a driver, allowing you to grasp the basics of insurance policies and ensuring you receive fair compensation after incidents like car accidents. Knowing how to navigate the claims process after an accident can significantly enhance your experience.

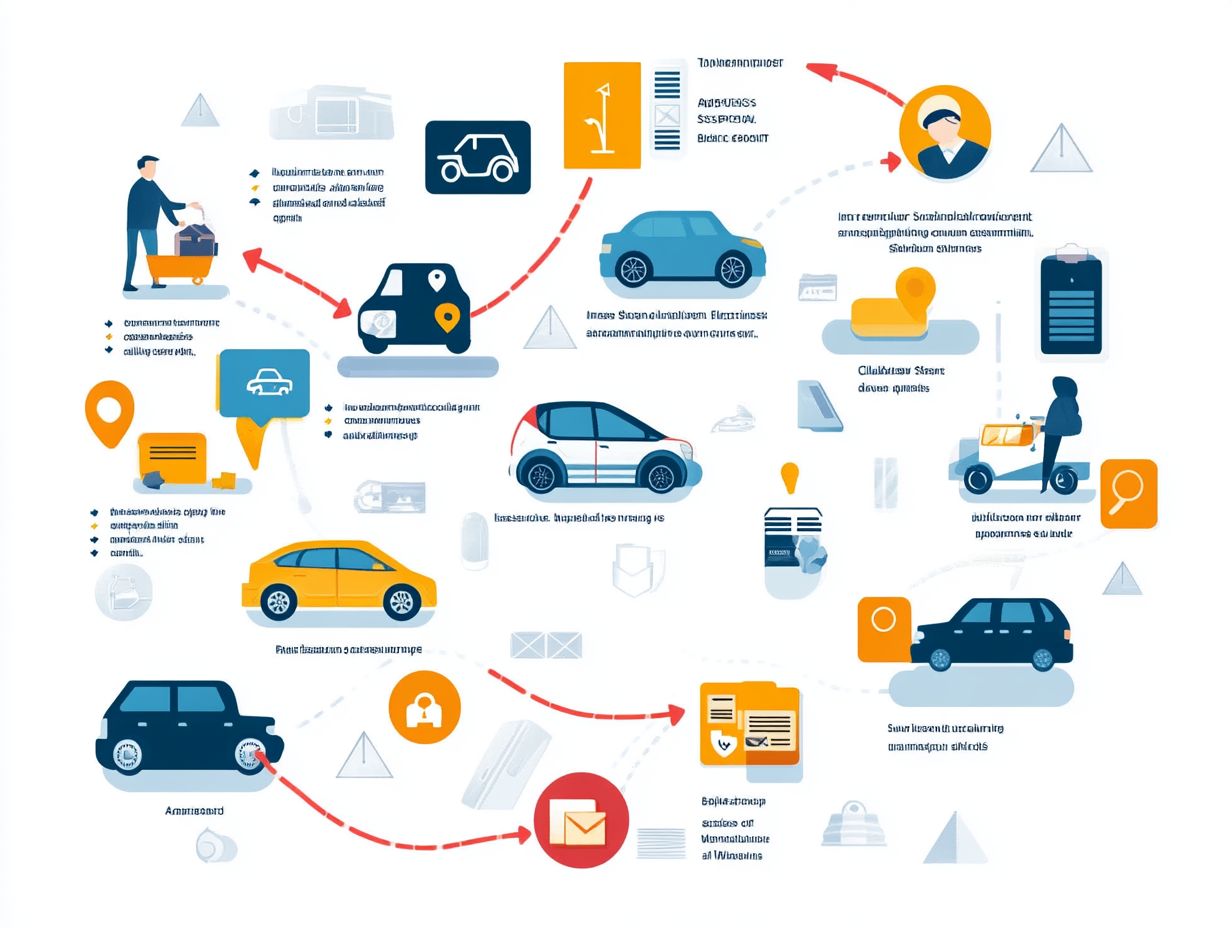

When you file an insurance claim, you re initiating a structured way to ask for help with costs from your insurance company for any damages or injuries incurred. This process entails several important steps:

- Reporting the accident

- Filing the claim

- Negotiating a settlement

Mastering each of these steps is vital for maximizing your recovery under Massachusetts law.

What is an Auto Insurance Claim?

An auto insurance claim is essentially your formal request to your insurance company for benefits under your policy after an incident like a car accident.

These incidents can vary widely, from minor fender benders to more serious collisions, theft, or even vandalism. Seeking financial compensation for vehicle repairs, medical expenses, or liability claims stemming from such incidents is crucial.

The claims process generally requires you to submit relevant documentation, such as police reports or photographs of the damage, along with a detailed account of what occurred.

Ultimately, grasping the different types of incidents that warrant a claim and the subsequent steps involved can help you navigate the complexities of insurance with confidence and ease.

Types of Auto Insurance Claims

Several types of auto insurance claims cater to different needs that may arise after an incident.

- Bodily injury claims cover medical expenses and lost wages stemming from injuries sustained in an accident, offering vital financial support as you recover.

- Property damage claims focus on the costs associated with repairing or replacing your damaged vehicle or any other affected property.

- If you need temporary transportation while your vehicle is being repaired or replaced, claims for rental car coverage become essential.

By understanding these distinct types and their eligibility requirements, you enable yourself to make informed decisions during what can be a challenging time.

The Auto Insurance Claim Timeline

The auto insurance claim timeline is a carefully structured sequence of events that unfolds after a car accident. It begins with your initial report of the incident and culminates in the final settlement with the insurance company, which is detailed in the claims process timeline.

This timeline guides you through critical steps such as the assignment of an adjuster, the assessment of damages, and the negotiation of your claims settlement. By understanding this timeline, you can manage your expectations effectively and ensure that all necessary documentation is submitted punctually, paving the way for a smooth claims process, including understanding the auto insurance claim denial process.

Start documenting your accident details today to ensure a smoother claims process!

Initial Steps to Take After an Accident

The initial steps you take after a car accident are crucial for effectively processing your insurance claim and ensuring every detail of the incident is documented properly.

- Assess safety. If it’s safe, move to a secure location to minimize any further risk of injury.

- Notify law enforcement. Having an official report can strengthen your claim process.

- Exchange information with the other party, including contact details and insurance information. This exchange is key to establishing accountability.

- Document the scene with photographs and witness statements. This creates a clear account of events, proving invaluable when you file claims.

Each of these actions plays a pivotal role in navigating the often complex claims journey, ensuring you re well-prepared for what lies ahead.

Filing the Claim

Filing an insurance claim is your formal request for compensation from the insurance company, marking the beginning of the claims process.

To ensure a seamless experience, gather all necessary information beforehand:

- Your policy numbers

- Details about the incident

- Any relevant photographs or documentation

When you communicate with the insurance provider, remember that clarity and organization are paramount. Providing a concise summary and sticking to the facts helps eliminate misunderstandings that might slow things down.

Regular follow-ups and polite inquiries keep your claim progressing smoothly, ensuring that all necessary steps are completed without unnecessary delays.

Investigation and Evaluation

The investigation and evaluation stage is where you ll find an adjuster from the insurance company assessing the accident details and determining the extent of damages.

This professional plays a crucial role in ensuring your claims are handled with fairness and accuracy. They evaluate the scene, scrutinizing photographs, witness statements, and police reports, while inspecting damaged properties or vehicles. Factors like the severity of injuries, repair costs, and potential liability issues come into play during this assessment.

Any additional damages that arise during the investigation, like unforeseen medical expenses or long-term vehicle depreciation, can significantly impact your final claim settlement. This makes the adjuster’s thorough evaluation essential for achieving a fair outcome.

Settlement Negotiations

Settlement negotiations represent a pivotal stage in the claims process, where you and the insurance company engage in discussions regarding compensation terms after an accident.

During this crucial time, it s vital for all parties to communicate clearly and effectively, thoroughly addressing every relevant detail. The demand letter often acts as a cornerstone in these discussions, outlining the specifics of your claim everything from medical expenses and property damage to lost wages.

By presenting a well-crafted demand letter, you underscore the rationale behind your compensation request while establishing a solid foundation for negotiations. Employing strategies like emphasizing pertinent evidence, maintaining composure, and demonstrating a willingness to compromise can significantly boost your chances of achieving a fair settlement that satisfies everyone involved.

What Happens When Your Claim is Resolved?

The final resolution of your auto insurance claim marks the conclusion of the claims process, resulting in either a settlement or further action if disputes arise.

Once a settlement is achieved, expect to receive a claim check, which might come directly to you or through your insurance agency. Make sure to thoroughly review the terms your satisfaction depends on it!

After receiving the payment, the next step involves addressing any potential disagreements or dissatisfaction with the settlement amount. If the settlement doesn’t meet your expectations, consider discussing your concerns with the insurance adjuster or seeking legal advice to explore options for negotiation or appeal. Clarity during this phase can significantly enhance your satisfaction with the resolution.

Factors That Can Affect the Claim Timeline

Several factors shape the timeline of your auto insurance claim. The severity of the damages plays a crucial role, as does the efficiency of your insurance provider’s processes. To better understand this, you can explore how long an auto insurance claim takes.

Legal issues or disputes can also affect how quickly your claim is resolved.

Type and Severity of Damage

The type and severity of damage from a car accident significantly influence how long the insurance claims process will take for you, making it crucial to follow the steps to file an auto insurance claim successfully.

When the accident involves only minor damage, like superficial scratches or small dings, the investigation often moves along quickly, leading to faster assessments and a more streamlined claims experience. However, when faced with severe damage like crumpled frames or extensive wreckage the situation becomes more complicated. This may require extra inspections and longer repair times.

Each of these factors not only prolongs the investigation but also raises the stakes for accurate documentation. Clearly outlining all damages ensures everyone involved has a complete understanding of the situation, which can ultimately impact settlement amounts and resolutions.

Insurance Company Processes

The internal processes of your insurance company can greatly impact the speed and efficiency of the claims process. Each insurer operates under its own unique set of protocols, meaning your experience as a policyholder can vary significantly.

Some companies prioritize quick evaluations to expedite claim settlements, while others may choose a more meticulous approach, possibly leading to delays in decisions. The technology used by these firms is also a critical factor; those with advanced claims management systems can streamline communication and assessments, while those sticking to traditional methods might face bottlenecks.

These discrepancies not only affect the speed at which your claims are processed but also play a crucial role in your overall satisfaction as you navigate your insurance needs.

Legal Issues or Disputes

Legal issues or disputes during the claims process can lead to substantial delays and complications in reaching a settlement.

These challenges often originate from misunderstandings about what you need to prove, interpretations of Massachusetts law, or even the procedural rules governing such claims. You might find yourself navigating the complexities of the Massachusetts General Laws, which can be daunting if you’re not well-versed in legal terminology and processes.

When faced with these intricacies, it s essential to seek guidance from experienced legal professionals who can provide clarity and support. By understanding your rights and the legal framework, you’ll be better positioned to negotiate effectively and work toward a favorable outcome.

Tips for a Smooth Auto Insurance Claim Process

- Ensure effective communication with your insurance company.

- Meticulously document the accident and all related information.

- Don t hesitate to reach out to your adjuster if you have questions!

Documenting the Accident and Damages

Documenting the accident and damages is crucial for your insurance claim. It helps streamline the claims process.

Take clear photos of the accident scene, vehicles involved, and any visible injuries. This visual evidence strengthens your claim.

Obtaining police reports is also essential. They provide unbiased accounts of the incident and help establish who is responsible.

Repair shop estimates outline repair costs. These documents help you understand the financial impact of the accident.

Together, these elements create a strong case that improves your chances of a successful claim.

Communicating Effectively with Your Insurance Company

Clear communication with your insurance company is key to navigating claims. It ensures you receive timely responses.

Be concise when interacting with agents. Have relevant information like policy numbers and incident dates on hand to avoid confusion.

Follow up on your claims to prevent delays. Taking the initiative can be beneficial.

Maintain a professional tone to foster a collaborative relationship. This alignment is vital for efficiently resolving your claim.

Frequently Asked Questions

What is an auto insurance claim timeline?

An auto insurance claim timeline outlines the steps and deadlines for filing and resolving a claim. It guides you through understanding the auto insurance claim process.

Why is understanding the timeline important?

Understanding the timeline helps you navigate the process efficiently, especially when you know what to expect after filing an auto insurance claim. This ensures you receive the compensation you deserve.

What is the typical time frame for filing a claim?

Typically, you should file a claim within 24 hours after an accident. Check your policy, as some companies have different deadlines.

How long does an insurance company have to investigate a claim?

Insurance companies usually have 30 days to investigate and decide on a claim. This can vary based on the claim’s complexity.

What happens if I miss a deadline?

Missing a deadline may lead to your claim being denied. Communicate any delays to your insurance provider right away.

Can I dispute an insurance company’s decision?

Yes, you can dispute the decision made by your insurance company. Provide additional evidence and use their dispute resolution process.

Act quickly if you wish to challenge their decision!