Understanding Minimum Coverage Requirements by State

Navigating the world of insurance can feel like a daunting task, especially when it comes to understanding minimum coverage requirements.

These regulations differ dramatically from state to state, shaped by various factors that cater to local needs and risks. This article will clarify what minimum coverage requirements entail, why they vary across states, and the potential consequences of not meeting them.

This article will also give you tips for securing affordable yet adequate coverage, ensuring you remain well-protected.

Let s dive in and arm yourself with the essential knowledge you need!

Contents

- Key Takeaways:

- Overview of Minimum Coverage Requirements

- Why do States have Different Requirements?

- State-by-State Minimum Coverage Requirements

- Understanding the Consequences of Not Meeting Minimum Coverage Requirements

- How to Ensure You Meet Minimum Coverage Requirements

- Frequently Asked Questions

- What are minimum coverage requirements by state?

- Why is it important to meet minimum coverage requirements?

- Do all states have the same minimum coverage requirements?

- What factors determine the minimum coverage requirements in each state?

- What types of insurance must be included in minimum coverage requirements?

- Do I need to purchase additional insurance on top of the state’s minimum coverage requirements?

- Can minimum coverage requirements change over time?

Key Takeaways:

- Understanding minimum coverage requirements is important for complying with state laws and avoiding penalties.

- States have different minimum coverage requirements due to factors such as population, driving habits, and insurance market competition.

- To ensure you meet minimum coverage requirements, research state-specific needs and consider affordable and adequate coverage options.

Overview of Minimum Coverage Requirements

Minimum coverage requirements for car insurance are essential regulations established by states to ensure drivers maintain adequate liability insurance. These requirements are crucial in protecting you from the financial consequences of auto accidents, ensuring you can handle costs related to property damage and bodily injury.

States like Florida, Texas, and Virginia mandate specific minimum coverage amounts that often include liability and Personal Injury Protection (PIP). Familiarizing yourself with these coverage requirements is vital for preserving your driving privileges and ensuring compliance with state laws.

What are Minimum Coverage Requirements?

Minimum coverage requirements refer to the legal mandates dictating the least amount of car insurance you must carry to comply with state laws.

These requirements are designed to ensure that you can financially cover damages resulting from accidents, ultimately fostering responsible driving behavior. Typically, the primary type of coverage mandated is liability insurance, which protects against costs stemming from injuries or property damage inflicted on others in an accident. In many states, Personal Injury Protection (PIP) is also required; this insurance covers medical expenses for you and your passengers, regardless of fault.

Such regulations exist to protect both drivers and pedestrians, guaranteeing that sufficient financial resources are available in the event of unforeseen incidents. These rules help create safer roads for all of us and provide greater peace of mind for everyone involved.

Why do States have Different Requirements?

States impose varying minimum coverage requirements for car insurance, shaped by a range of factors such as economic conditions, population density, and legislative priorities that dictate financial responsibility mandates.

Factors that Influence Minimum Coverage Requirements

Several factors influence minimum coverage requirements, including economic conditions, vehicle registration rates, and historical data on accident damages and claims.

These elements are vital in determining the liability insurance levels necessary for protecting drivers and ensuring financial stability in the event of accidents. For example, states with higher vehicle registration rates often experience more incidents on the road, which leads regulators to increase minimum coverage to effectively manage potential costs associated with accidents.

The economic landscape in a region can also dictate how much you re willing to invest in insurance, striking a balance between affordability and adequate protection. Additionally, historical data on accident damages sheds light on typical claims, allowing policymakers to establish levels that accurately reflect real-world risks while safeguarding both the public and the insurance industry.

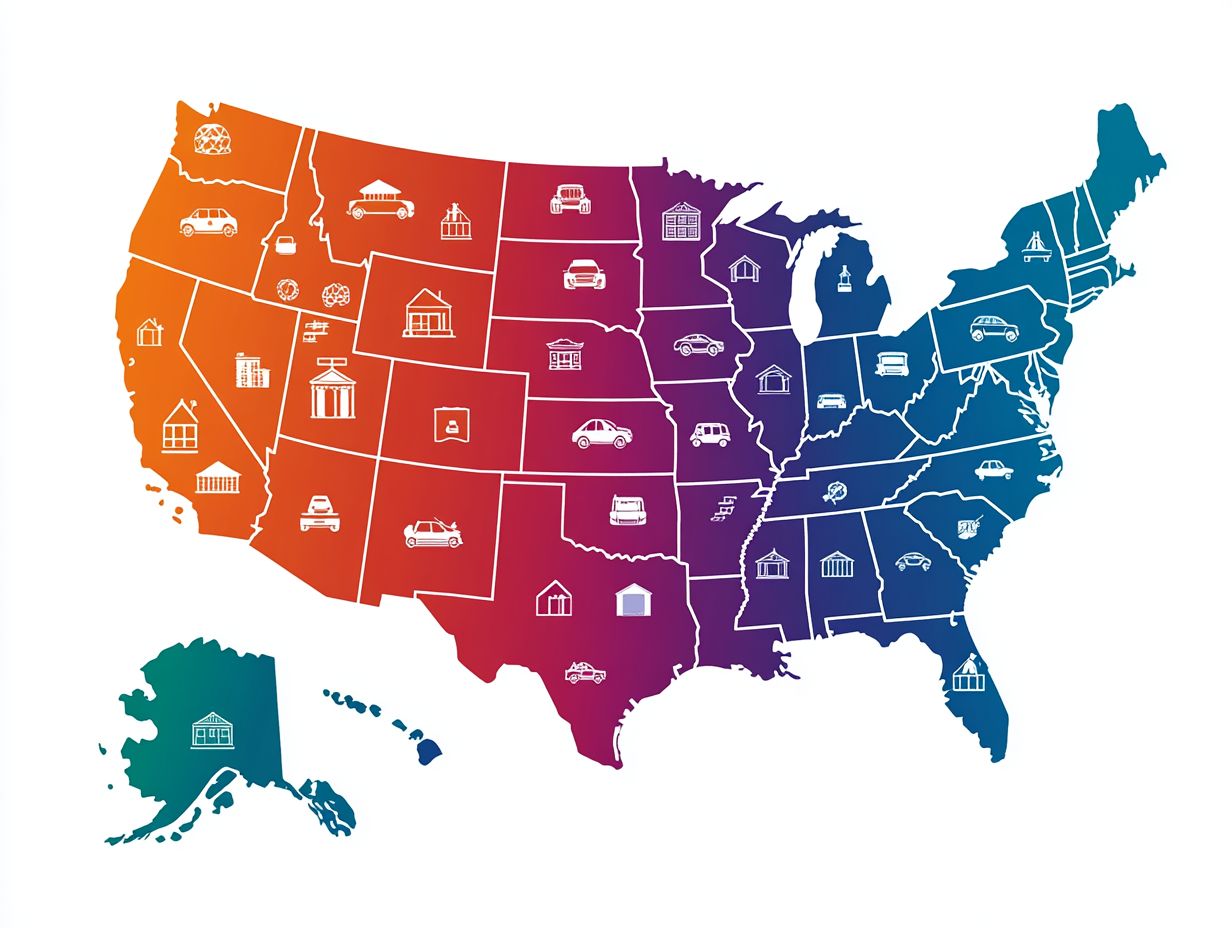

State-by-State Minimum Coverage Requirements

State-by-state minimum coverage requirements vary significantly across the United States, making it crucial to understand minimum coverage in Georgia as you navigate selecting car insurance policies.

Understanding these variations is essential to ensure that you make informed choices tailored to your specific needs.

Comparison of Minimum Coverage Requirements by State

When you compare minimum coverage requirements by state, you’ll notice significant variations in liability insurance, uninsured motorist coverage, and financial protection rules.

These differences can greatly influence your finances and insurance choices. For example, states like New York require higher liability limits, which may increase premiums. However, they also provide better protection in the unfortunate event of an accident.

Conversely, states such as South Dakota may have lower requirements, resulting in cheaper rates, but this could leave you exposed if you encounter uninsured motorists or face substantial damages.

Knowing these mandates helps you maintain financial responsibility while exploring your coverage options.

Understanding the Consequences of Not Meeting Minimum Coverage Requirements

Neglecting to meet the minimum coverage requirements can result in significant repercussions, including penalties, fines, and the potential loss of your driving privileges. It s essential to stay informed and compliant to avoid these serious outcomes.

Possible Penalties and Risks

Failing to meet minimum coverage requirements can lead to serious penalties, including hefty fines, increased insurance rates, and even the suspension of your driving privileges.

Beyond these immediate consequences, you may encounter legal repercussions, such as civil lawsuits for damages arising from accidents where your coverage was insufficient. The financial strain can escalate quickly, as lacking proper insurance makes you responsible for out-of-pocket expenses related to medical bills or property damage claims.

Unpaid judgments can lower your credit score, which can impede your future financial opportunities. Understanding these risks is essential for safeguarding both your financial stability and legal standing.

How to Ensure You Meet Minimum Coverage Requirements

Meeting the minimum coverage requirements for car insurance necessitates a thorough understanding of state laws, a careful evaluation of your insurance options, and a diligent search for the best coverage at competitive rates.

Get informed to find the best coverage! Explore various offerings to secure the protection you need while maximizing value.

Tips for Finding Affordable and Adequate Coverage

Finding affordable and adequate coverage requires a thoughtful approach to various insurance options, premium rates, and coverage limits that align with state requirements.

To kick off the process, gather quotes from multiple providers, giving you a clear picture of your market options. Utilizing online comparison tools can be incredibly beneficial, allowing you to evaluate premiums side-by-side with ease.

It’s crucial to assess your personal coverage needs:

- Driving habits

- Type of vehicle

- Preferred deductible amounts

Understanding these factors can help you determine the most suitable policy. Additionally, regularly reviewing and updating your coverage can lead to better deals, ensuring you never miss out on potential savings.

Frequently Asked Questions

What are minimum coverage requirements by state?

Minimum coverage requirements by state refer to the minimum amount of insurance coverage that is required for drivers in a specific state to legally operate a vehicle.

Why is it important to meet minimum coverage requirements?

Meeting minimum coverage requirements protects you from legal penalties and ensures that you are financially safeguarded in the event of an accident.

Do all states have the same minimum coverage requirements?

No, each state sets its own minimum coverage requirements based on its specific laws and regulations.

What factors determine the minimum coverage requirements in each state?

Minimum coverage requirements vary by state. They are influenced by factors such as population density, repair costs, and the number of uninsured drivers.

What types of insurance must be included in minimum coverage requirements?

Minimum coverage usually includes liability insurance. This covers damage or injuries you cause in an accident. It may also include protection against uninsured or underinsured drivers.

Do I need to purchase additional insurance on top of the state’s minimum coverage requirements?

You should buy extra insurance beyond the state’s minimum. These minimums might not be enough if you’re in a serious accident.

Can minimum coverage requirements change over time?

Yes, minimum coverage can change over time. Stay informed; regularly check your insurance to ensure it meets your state’s current requirements.