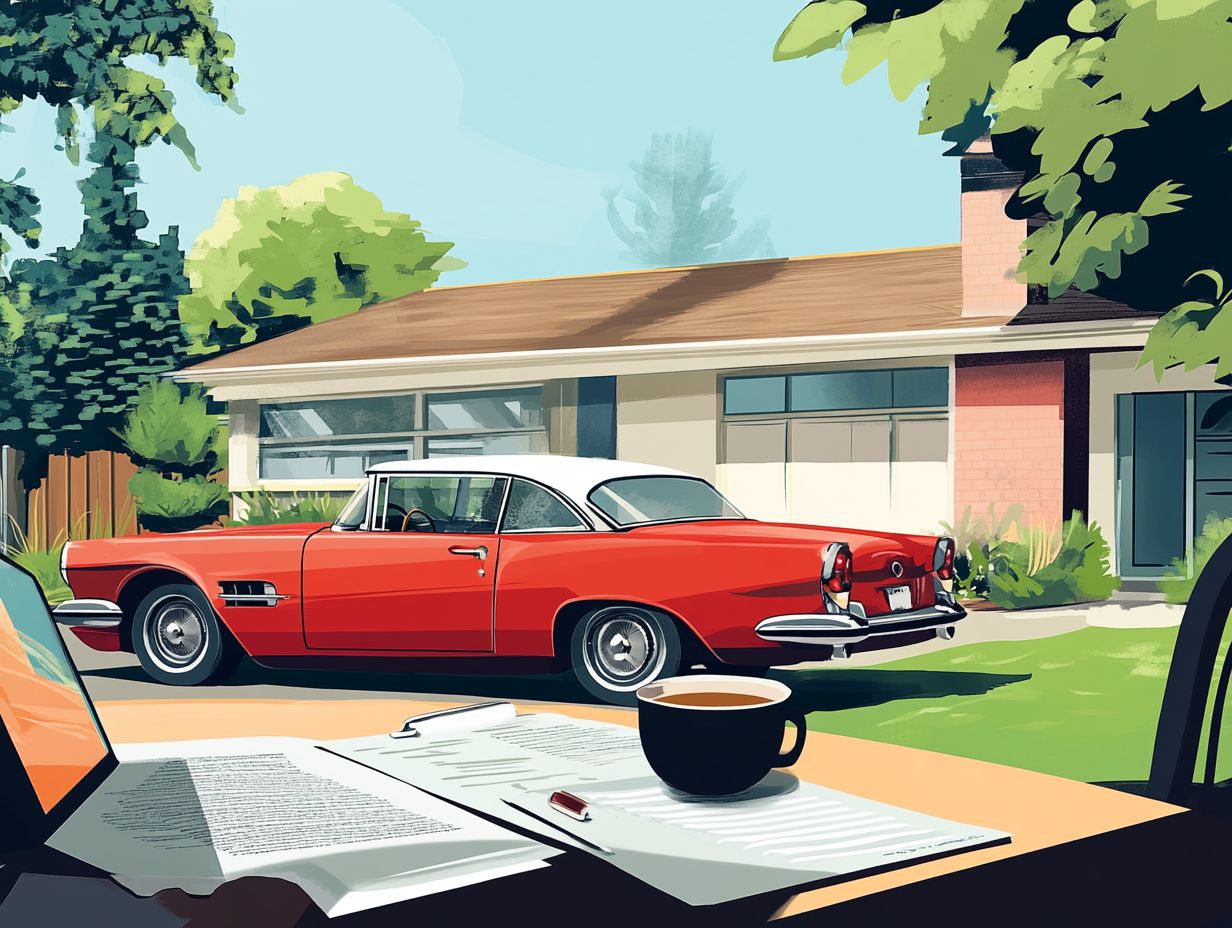

How to Get Insurance for a Classic Car?

Classic cars are not merely vehicles; they embody a rich history, timeless design, and a fervent passion for automotive excellence. When it comes to insuring your treasured classic, a different approach is essential compared to standard car insurance.

This guide delves into the details of classic car insurance, highlighting how it differs from conventional policies. It also covers the key factors you should consider when selecting the right coverage. Furthermore, it will walk you through the process of obtaining insurance and provide valuable tips for maintaining your policy.

Whether you re a seasoned collector or a first-time classic car owner, this information empowers you to navigate the unique landscape of classic car insurance with confidence!

Contents

- Key Takeaways:

- Understanding Classic Car Insurance

- Factors to Consider When Choosing Classic Car Insurance

- The Process of Getting Classic Car Insurance

- Tips for Maintaining Classic Car Insurance

- Frequently Asked Questions

- What is considered a classic car for insurance purposes?

- How do I determine the value of my classic car for insurance?

- Do I need a special type of insurance for my classic car?

- Can I get insurance for a classic car that is not in working condition?

- Are there any discounts available for insuring a classic car?

- Do I need to provide proof of ownership when insuring a classic car?

Key Takeaways:

- Classic car insurance is a specialized type of coverage tailored to the unique needs of vintage and collectible vehicles.

- When choosing classic car insurance, consider the car’s age and condition, usage restrictions, and coverage options.

- To obtain classic car insurance, research and comparison shopping are important. Having the required documentation and understanding payment options are crucial. Regular maintenance and careful record-keeping can help you maintain coverage.

Understanding Classic Car Insurance

Understanding classic car insurance is essential if you love cars and own collector vehicles, especially antique cars, vintage motorcycles, or military vehicles.

This specialized form of insurance offers unique protection tailored to classic cars. It presents significant differences from standard auto policies.

Typically, classic car insurance includes liability, comprehensive, and collision coverage. This ensures that your cherished vehicles are adequately protected, whether they re cruising down the road or resting in storage.

It s crucial for you to grasp agreed value, which means you and the insurance company agree on a certain amount your car is worth, along with usage restrictions and eligibility criteria to select the right policy for your classic or collector vehicle.

What Exactly is Classic Car Insurance?

Classic car insurance, commonly known as collector car insurance, is a specialized auto policy crafted to meet the distinct needs of vintage and antique vehicles.

This type of insurance is essential for enthusiasts and collectors who understand that these cherished possessions require more than just standard coverage! Unlike conventional auto policies, classic car insurance typically provides tailored benefits such as agreed value coverage, ensuring you receive a predetermined amount in the event of a total loss.

These policies often include coverage for spare parts and customization, acknowledging the significant investment involved in restoring or maintaining these vehicles. Understanding these features is crucial for you as a collector; they protect your financial interests and help preserve the true value of your automobiles over time.

Why is it Different from Regular Car Insurance?

Classic car insurance sets itself apart from regular car insurance primarily through its specialized coverage options, such as agreed value, comprehensive coverage, and collision coverage tailored specifically for classic cars.

These customized options are essential for owners who recognize that classic cars often appreciate in value over time. It is vital to ensure they’re adequately protected. Unlike standard vehicles, classic cars may have unique repair needs or require specialized parts that can be challenging to source, adding complexity to your insurance considerations.

As a classic car enthusiast, you likely invest considerable time and effort into maintenance and restoration. Your insurance policy should reflect that dedication! By choosing classic car insurance coverage specifically designed for vintage vehicles, you can rest easy knowing that your treasured cars are safeguarded against unexpected incidents. Don’t wait until it’s too late!

Factors to Consider When Choosing Classic Car Insurance

When selecting classic car insurance, consider several key factors:

- The age and condition of your vehicle.

- Any usage restrictions.

- Your driving record.

Taking these elements into account will help ensure that your classic car is adequately covered. You will also receive the best possible policy tailored to your needs.

Age and Condition of the Car

Have you ever wondered how the age of your classic car affects your insurance? The age and condition of a classic car significantly impact your insurance coverage options and premiums.

If you ve meticulously maintained your vehicle over the years, you may qualify for specialized insurance policies. These policies offer unique benefits tailored specifically for classic cars, providing better coverage choices compared to standard auto policies. Insurers recognize the cultural and historical value these vehicles embody.

Well-preserved classics often enjoy lower premiums. Owners of these vehicles tend to be more conscientious about maintenance and usage, creating a reduced risk profile for insurers. This makes insuring such vehicles not only appealing but also financially advantageous for enthusiasts like you.

Usage and Mileage Restrictions

Usage and mileage restrictions are essential elements of classic car insurance policies. They define how and when you can take your prized vehicle for a spin. These guidelines play a pivotal role in safeguarding both you, the car owner, and the insurer.

Understanding mileage limits is crucial especially if you envision weekend getaways or showcasing your car at events. For vehicles that spend most of the year in storage, the implications are different compared to those that see daily use. A classic car that s tucked away has distinct coverage needs, as it won’t accumulate mileage or endure the same wear and tear as your everyday driver.

By acknowledging these differences, you can adopt a more customized approach to insurance. This way, both your passion and investment are effectively protected.

Coverage Options

Classic car insurance presents a range of coverage options designed specifically for the discerning collector. These include premium protection, liability coverage, comprehensive coverage, and collision coverage.

These tailored options enable you to choose a level of protection that aligns with your unique needs. This effectively balances value, risk, and how you use your classic vehicle. Premium protection often includes extra benefits, such as agreed value coverage, which ensures that if you suffer a total loss, you receive a pre-established value for your prized possession.

Liability coverage protects you from the financial repercussions of damages caused to others during an accident. Comprehensive coverage safeguards against non-collision incidents think theft or natural disasters. Collision coverage addresses damages from accidents involving other vehicles or stationary objects.

Understanding these distinctions is crucial. Selecting the right coverage not only protects your classic car s value but also secures your financial well-being.

The Process of Getting Classic Car Insurance

Ready to dive into classic car insurance? Start by engaging in thorough research and comparison shopping. This involves gathering the necessary documentation and evaluating costs and payment options.

By doing so, you can secure the best policy tailored to your specific needs.

Research and Comparison Shopping

Conducting thorough research and comparison shopping is essential when selecting classic car insurance. This helps you find the policy that perfectly aligns with your needs.

With a plethora of insurance providers available, each presenting unique policies, it s crucial to understand what sets one offer apart from the others. Consider the coverage features tailored specifically for classic vehicles, as these can vary significantly from standard car insurance.

Premiums are another critical factor to assess, as they can fluctuate widely based on the insurer’s perception of risk. The quality of customer service also impacts your experience, especially when it s time to file a claim or seek assistance with your policy.

Investing time in comparing these elements can lead you to a well-informed decision that suits your unique situation.

Ready to protect your classic car? Start comparing policies today!

Required Documentation

When you apply for classic car insurance, you need to gather several key documents to meet the specific requirements associated with classic vehicles, including understanding what is coverage for antique cars.

These documents verify your car’s unique status and help insurance providers assess its true value. Essential items include proof of ownership like a title or a bill of sale which confirms your legal possession of the vehicle. You ll also need a detailed description of your car’s state, often prepared by professional appraisers.

Don’t forget to include clear, comprehensive photographs taken from multiple angles to showcase both the aesthetic and mechanical condition of your prized possession. Gathering these documents isn’t just a task; it s the first step to protecting your classic treasure!

Costs and Payment Options

Understanding the costs associated with classic car insurance and the available payment options is crucial for you as a budget-conscious car enthusiast seeking top-tier protection.

These costs can fluctuate significantly based on various factors, including the vehicle’s value, usage, and the level of coverage you choose. Premiums often reflect the condition and rarity of your classic car, so be prepared for a range of rates.

Deductibles are essential in determining your out-of-pocket expenses when filing a claim. By exploring multiple providers, you can discover flexible payment options, such as monthly installments or annual premiums, enabling you to select a method that aligns with your financial situation.

Some insurers offer discounts for safe driving or bundling coverages, making the journey of classic car ownership more manageable.

Tips for Maintaining Classic Car Insurance

To maintain classic car insurance effectively, prioritize regular maintenance and care of your vehicle. Keep meticulous records and documentation that substantiate your coverage. Understanding what is coverage for vintage cars is essential; this diligence protects your investment and ensures you are fully prepared should you need to file a claim.

Regular Maintenance and Care

Regular maintenance is essential for preserving the value and functionality of classic cars, which directly influences your insurance coverage.

A well-maintained classic vehicle serves as a proud testament to automotive history and can command a higher resale value. Schedule regular check-ups to avoid unexpected breakdowns that can lead to costly repairs. Insurers tend to favor vehicles with documented upkeep, often offering better coverage or lower premiums.

By investing time and resources into routine inspections, oil changes, and necessary repairs, you create a safer driving experience and protect your investment from depreciation.

Keeping Records and Documentation

Maintaining meticulous records and documentation is crucial for classic car insurance policyholders. It supports claims and verifies the condition and value of your vehicle.

This diligence safeguards your investment and ensures any modifications made over the years are well-documented a factor that can significantly impact the insurance claims process. When the unexpected happens, having thorough records minimizes disputes with providers, allowing for a smoother approach to handling claims.

Keeping a detailed history of maintenance and repairs can enhance your vehicle s resale value. By prioritizing proper documentation, you cultivate a sense of security, confident in your preparedness for any eventuality.

Frequently Asked Questions

What is considered a classic car for insurance purposes?

A classic car for insurance purposes is typically a vehicle that is at least 20 years old, maintains its original appearance, has historical or collectible value, and is not used as a primary mode of transportation.

How can I keep my classic car insured while it s in storage?

Some insurers offer specialized coverage options for classic cars that are in storage. It s best to consult your insurance provider for details.

Ready to protect your classic ride? Start your insurance application today!

How do I determine the value of my classic car for insurance?

To determine the value of your classic car, research its market value. Consider its condition, modifications, and consult an appraiser or insurance agent.

Do I need a special type of insurance for my classic car?

Most traditional auto insurance policies don’t cover classic cars well. You need a specialized classic car insurance policy that addresses the unique risks of owning one.

Can I get insurance for a classic car that is not in working condition?

Yes! Options like storage or restoration insurance are available. Discuss your needs with an insurance provider to find the best coverage.

Are there any discounts available for insuring a classic car?

You may qualify for discounts, such as a multi-vehicle discount or savings for completing a defensive driving course. Always ask your insurance provider about applicable discounts.

Do I need to provide proof of ownership when insuring a classic car?

Yes, most insurance providers require proof of ownership. This could be a title, bill of sale, or documentation from a classic car club.