How to Handle Insurance When Moving to a New State?

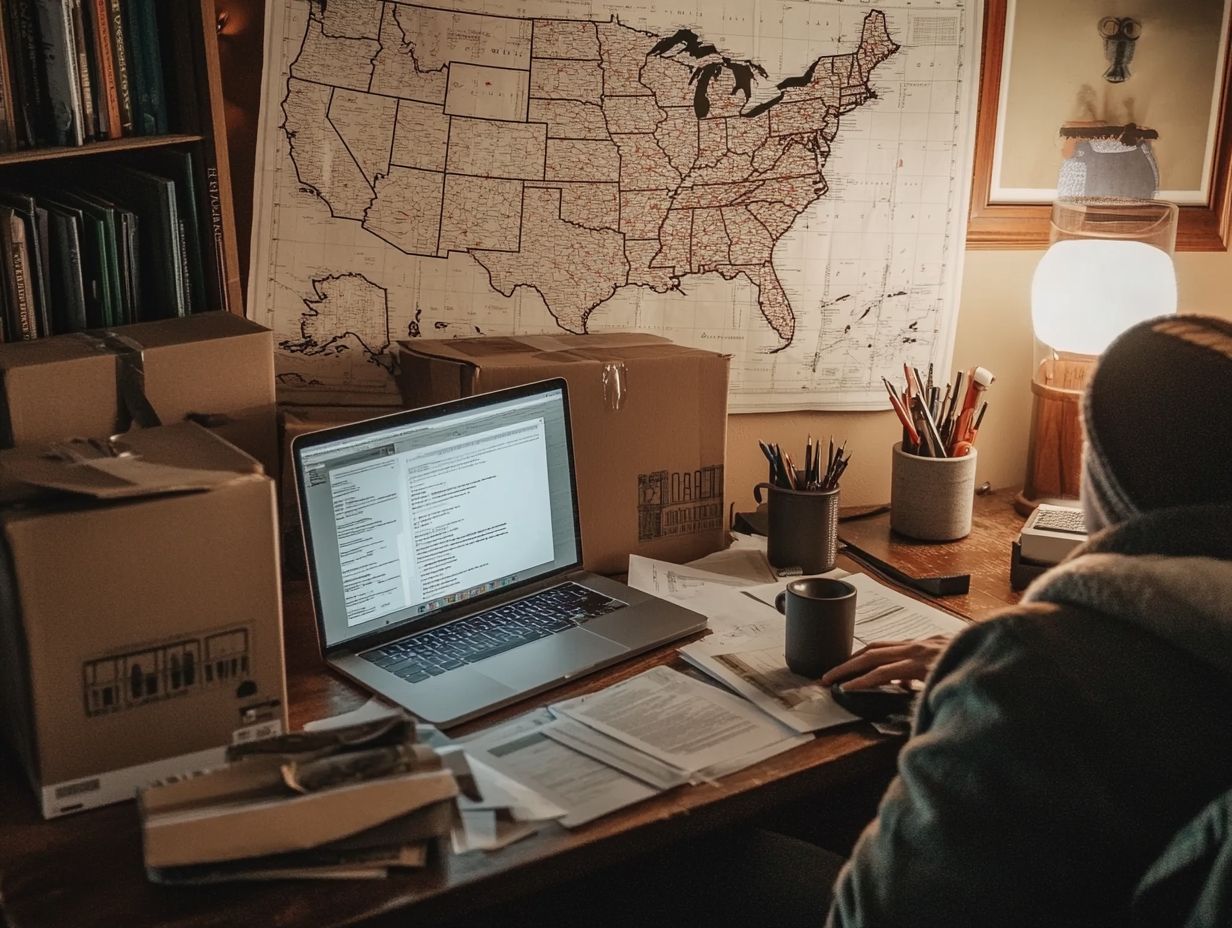

Relocating to a new state sparks excitement and opens doors to fresh opportunities. However, it can also introduce complexities to your insurance coverage.

It s essential to understand how your coverage might be affected to ensure a seamless transition. From updating your address and researching specific state requirements to navigating changes in policies and costs, there s a considerable amount to manage.

This guide will help you manage your insurance as you move, guaranteeing that you re thoroughly prepared for this new chapter in your life.

Contents

- Key Takeaways:

- Understanding Insurance Coverage When Moving

- Preparing for the Move

- Researching Insurance Requirements in the New State

- Transferring or Obtaining New Insurance Policies

- Dealing with Cancellations or Changes in Coverage

- Tips for Keeping Insurance Costs Low

- Frequently Asked Questions

- 1. What types of insurance do I need when moving to a new state

- 2. Do I need to cancel my current insurance policies before moving to a new state

- 3. Can I transfer my current insurance policies to my new state

- 4. How do I find new insurance providers in my new state

- 5. Is there a grace period for obtaining new insurance policies in my new state

- 6. Can I keep my current insurance agent when moving to a new state?

Key Takeaways:

- Update your contact information and research insurance requirements in your new state to ensure continuous coverage.

- Consider transferring or obtaining new insurance policies to comply with state-specific laws and regulations.

- Be aware of factors that may affect insurance rates in your new state and take steps to keep costs low.

Understanding Insurance Coverage When Moving

Understanding your insurance coverage during a move is essential for ensuring your vehicle stays protected as you transition to a new state. Car insurance serves as a critical safety net, offering financial protection against accidents and theft during this period of change.

Consider how your insurance provider might adjust your policy, coverage options, and rates based on your new location. This can also influence your claims history and overall insurance requirements.

As you get ready for the moving process, conducting an insurance review will help you maintain the necessary coverage as the insurance landscape shifts.

Types of Insurance That May Be Affected

When you re moving, several types of insurance can come into play, with auto insurance being at the forefront. This includes essential coverage options like liability coverage, underinsured motorist coverage, and personal injury protection. Each of these is vital for safeguarding you and your vehicle against various situations during your transition.

As you relocate to different states, understanding how these coverages change is vital for a smooth transition! Liability coverage, for instance, can vary significantly some states require higher minimums due to different legal thresholds for accidents.

Underinsured motorist coverage is another key component. In some areas, it’s optional, while in others, it s a must-have, ensuring you re protected if you encounter uninsured or inadequately insured drivers.

Personal injury protection can also vary from place to place, with some regions offering more comprehensive options that cover medical expenses and lost wages. Don t overlook property damage liability; it secures your financial responsibility for any damage caused to someone else’s property, helping you maintain peace of mind throughout the moving process.

Preparing for the Move

Preparing for a move involves several essential steps, and one of the most crucial is updating your address. This not only informs your insurance provider of your new location but also ensures that your insurance policy remains valid and effective.

Taking this proactive approach can also influence your moving costs. Timely updates may even qualify you for discounts on your insurance, providing you with added financial protection against unexpected expenses that might arise.

Don t wait! Prepare your insurance now to ensure you re fully covered during your move.

Updating Your Address and Contact Information

Updating your address and contact information with your insurance provider is essential during a move.

This simple action ensures a seamless transition for your driver s license and vehicle registration. It aligns perfectly with your new state’s insurance requirements.

When you neglect to inform your insurance company about a change of address, you open yourself up to potential complications. The effectiveness of your coverage could be jeopardized, and any claims might face delays or outright denials especially if you find yourself in an accident in unfamiliar territory.

Discrepancies in your documentation could lead to legal issues, complicating your driving privileges. Having accurate information is vital not only for maintaining compliant coverage but also for ensuring that your premium rates reflect local standards and risks.

With various state mandates regarding insurance, providing updated details safeguards you against unnecessary fines or penalties while facilitating a smoother adaptation to new driving regulations.

Researching Insurance Requirements in the New State

Researching the insurance requirements in your new state is crucial for compliance and ensuring that you meet all necessary regulations, which may vary significantly from state to state.

By gaining a clear understanding of the local insurance market, including the specific auto insurance laws enforced by the agency that handles vehicle registrations and driver licenses, you help yourself understand the differences in required coverage and premiums with confidence.

State-Specific Laws and Regulations

State-specific laws and regulations are important in defining your auto insurance coverage requirements. This includes mandatory liability coverage and other essential protections that differ from one state to another.

This variability determines what you must have to drive legally, and it can affect your premiums! For example, while some states offer a wide array of coverage options, others enforce stricter minimums.

Grasping these nuances is essential, as they can have a substantial impact on your overall insurance costs. Many states also provide specific discounts linked to their regulations, rewarding responsible driving behaviors or the choice of safe vehicles.

By staying informed about these differences, you ensure that you are adequately protected without overpaying for coverage you don t need.

Transferring or Obtaining New Insurance Policies

When you re transferring or obtaining new insurance policies after a move, it s crucial to thoughtfully consider your previous claims history alongside the services provided by various insurance providers, including well-respected names like Progressive.

Evaluating your current auto insurance policy for compatibility with your new state’s requirements is essential to ensure a seamless transition.

Options for Existing Policies

When you re exploring options for your existing policies, assess whether your current insurance provider can continue to offer you the financial protection and coverage that align with the new state s rates and requirements.

This means not just reviewing your current coverage but also considering adjustments that could enhance your benefits under the new regulations.

You should definitely think about the possibility of switching to a different insurer if you discover that your current one isn t able to meet your financial or coverage needs.

Conducting a meticulous comparison of your policy against state mandates is essential; it ensures that your protections remain robust.

Additionally, evaluating the potential costs of switching providers can help you determine whether keeping your existing policy is the most economical choice in the long run.

Dealing with Cancellations or Changes in Coverage

Navigating cancellations or changes in coverage is a crucial part of the moving process. It’s essential to have a clear grasp of cancellation terms and how they influence your insurance provider’s capacity to deliver financial protection during this transitional phase.

Understanding these details ensures that you are adequately shielded while you settle into your new surroundings.

Stay informed and act quickly to ensure you re always protected on the road!

How to Handle Changes in Policies or Providers

Handling changes in policies or providers requires a thorough analysis of your insurance. Consider your claims history and the offerings of various agents to secure the best coverage for your auto needs.

This process involves a careful review of your current insurance and any potential gaps. It also includes a review of your claims history to see how past events might impact future premiums. Collaborating with knowledgeable insurance agents can provide you with invaluable insights. They can guide you through the often intricate landscape of available policies.

It s wise to regularly reassess your coverage needs. Changes in personal circumstances, like shifts in driving habits or the purchase of a new vehicle, may necessitate adjustments to your policy. Ultimately, an informed analysis forms the foundation for making educated decisions about which policy aligns best with your requirements.

Tips for Keeping Insurance Costs Low

Managing your insurance costs is crucial, especially when planning a move! There are several effective strategies you can employ to achieve this, such as:

- actively seeking out insurance discounts

- gaining a clear understanding of the factors that influence your insurance rates, including your claims history and the overall costs associated with your move.

Factors That Affect Insurance Rates in a New State

Several factors will influence your insurance rates as you transition to a new state. Local regulations, your claims history, and the specific coverage requirements mandated by state authorities can all significantly shape your financial protection.

Geographical areas are paramount in this equation. Insurance rates can fluctuate dramatically based on the risk factors associated with your location. For instance, urban environments may impose higher premiums due to elevated risks of theft or accidents, whereas rural areas might present more budget-friendly options.

Factors like your age and driving history also come into play. Younger drivers often face steeper costs compared to their more seasoned counterparts. Understanding these elements is essential for navigating local markets, enabling you to tailor your coverage effectively and sidestep any unexpected financial burdens.

Frequently Asked Questions

1. What types of insurance do I need when moving to a new state

When moving to a new state, it is important to handle your health insurance, car insurance, and renter’s/homeowner’s insurance. For a comprehensive approach, check out what to do when moving to a new state, as you may also need to consider life insurance, disability insurance, and pet insurance based on your specific situation.

2. Do I need to cancel my current insurance policies before moving to a new state

It is recommended to contact your insurance providers and notify them of your move. In most cases, you will need to cancel your current policies and obtain new ones in your new state. If you’re unsure about the process, you can find out more about what happens when I move to a new state. However, some insurance companies may offer coverage in multiple states, so it’s best to confirm with them.

3. Can I transfer my current insurance policies to my new state

In some cases, you may be able to transfer your current policies to your new state. This is typically an option for auto and renter’s/homeowner’s insurance. Health insurance, on the other hand, may require you to enroll in a new plan in your new state.

4. How do I find new insurance providers in my new state

You can start by researching online for insurance providers in your new state. You can also ask for recommendations from friends, family, or your current insurance agents. It’s important to compare quotes and coverage options to find the best fit for your needs and budget.

5. Is there a grace period for obtaining new insurance policies in my new state

It is important to obtain new insurance policies as soon as possible after your move. However, some states may have a grace period for obtaining new insurance before your current policies are canceled. It’s best to check with your new state’s insurance regulations to avoid any gaps in coverage.

6. Can I keep my current insurance agent when moving to a new state?

You can keep your insurance agent if they are available in your new state. If not, don t worry you will need to find a new agent.

Ask your current agent for recommendations or search for agents online in your new state. Make sure to take this step early to ensure you have coverage when you move!