What Are the Different Coverage Levels?

Choosing the right insurance coverage can be daunting. You have a multitude of options at your fingertips.

It’s essential to understand the different coverage levels comprehensive, collision, and liability so you can protect yourself and your vehicle.

This article explores the various types of coverage, the factors that influence your decisions, and how to assess your unique needs and budget.

Once you finish reading, you ll feel confident and ready to tackle your insurance choices!

Contents

Key Takeaways:

- There are different types of coverage levels, such as comprehensive, collision, liability, and uninsured/underinsured motorist coverage, that offer varying protection for your vehicle and finances.

- The cost of premiums, state requirements, and vehicle type and usage can impact the coverage level you need and the cost of your policy.

- Evaluate your personal needs and budget when selecting the right coverage level for your car insurance policy.

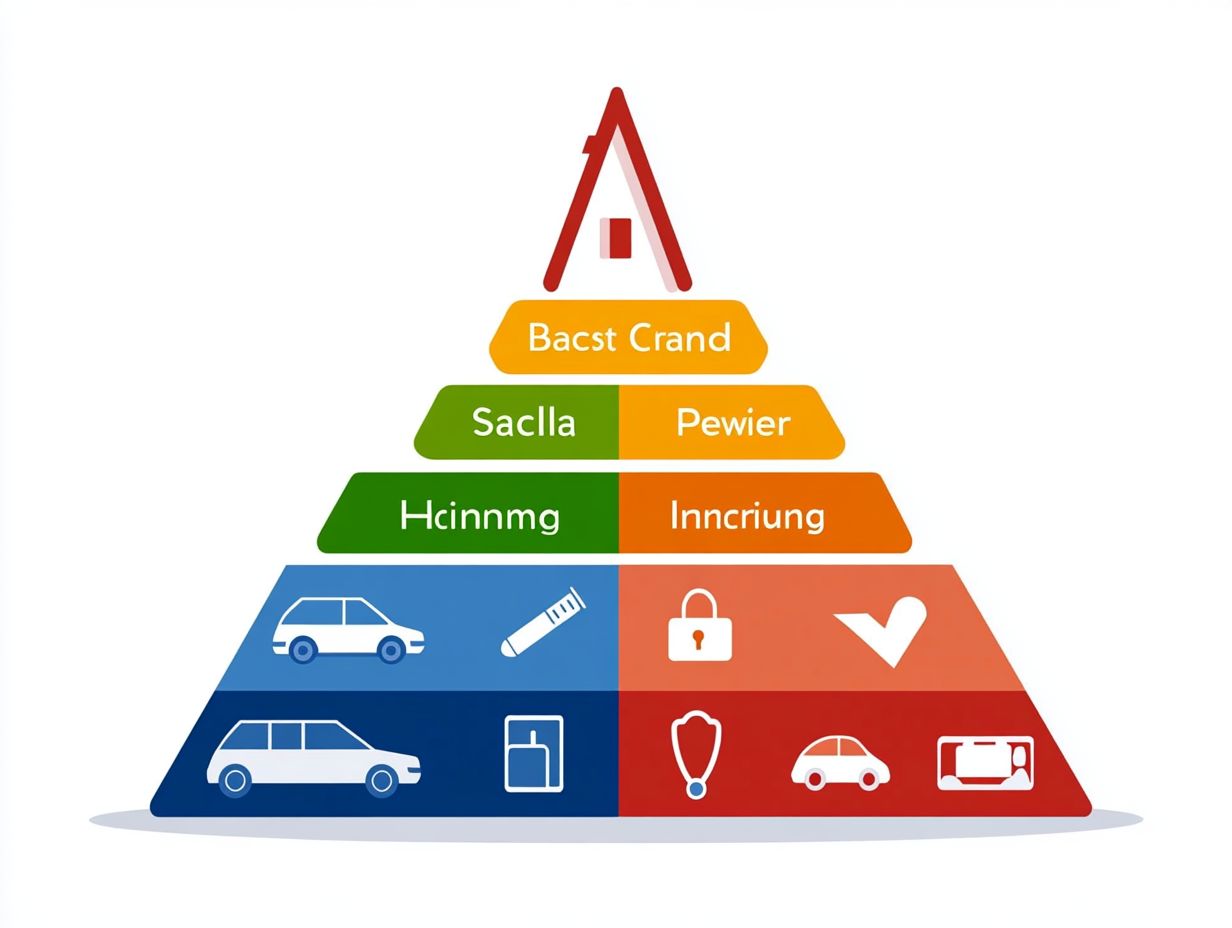

Understanding Coverage Levels

Understanding coverage levels in car insurance is crucial for making informed financial decisions. It also ensures you have enough money to cover damages as mandated by state regulations.

As you navigate insurance options, you ll find different companies provide various coverage choices. This includes mandatory coverage like liability and optional coverage such as comprehensive and collision. Each coverage level is tailored to meet specific needs and preferences, influenced by factors like your comfort with risk, vehicle type, and budget.

It s essential to grasp the implications of choosing one coverage level over another. This decision can significantly impact your financial well-being.

Explanation of Different Coverage Levels

Different coverage levels in car insurance are crucial for protecting you and your assets. You’ll encounter options like liability coverage, which compensates for damages incurred by others, and personal injury protection, which covers your medical expenses.

Understanding liability coverage is essential. It generally consists of two main components:

- Bodily Injury Liability: This covers medical costs and lost wages for individuals injured in an accident you caused.

- Property Damage Liability: This pays for repairs to someone else s vehicle or property.

Personal injury protection goes further by covering lost income and rehabilitation expenses, creating a strong safeguard for you and your passengers. Medical payments coverage also enhances this protection by providing immediate payment for medical bills, regardless of fault. This ensures you have a comprehensive safety net in case of an incident on the road.

Types of Coverage Levels

When navigating car insurance, you ll find a variety of coverage levels designed to meet your needs.

Comprehensive coverage is a valuable option that protects you against incidents not related to collisions. Collision coverage addresses damage from accidents, while liability coverage protects you from the financial repercussions of damages inflicted on others during an accident.

Choosing the right combination ensures you’re well-protected on the road.

Start reviewing your options now to find the best coverage for your needs!

Comprehensive Coverage

Comprehensive coverage protects your car from damage caused by theft, vandalism, and natural disasters. It’s a must-have for any solid insurance policy.

This coverage is especially helpful during unexpected events, like when a hailstorm damages your car or a tree branch falls on it. If you live in an area prone to theft, this insurance gives you peace of mind.

When you need repairs, comprehensive coverage can help ease financial stress. To get a quote, contact various providers and ask about their comprehensive options.

Collision Coverage

Collision coverage is vital for drivers. It helps pay for repairs after any accident, regardless of who is at fault.

For instance, if someone rear-ends you or you hit a tree, this coverage will help you pay for repairs. You can choose your deductible, which affects your premium higher deductibles usually mean lower monthly payments.

When you file a claim, the check issued will be based on the calculated repair costs minus your chosen deductible. This coverage helps maintain your vehicle’s value and prevents repair costs from becoming a financial burden after an accident.

Liability Coverage

Liability coverage is crucial for your car insurance. It protects you from financial loss by covering costs related to bodily injury and property damage in an accident.

This coverage alleviates immediate expenses like medical bills and repairs. It also ensures you are prepared for the costs associated with injuries or damages from an accident, protecting you from potential financial strain.

Exceeding your liability limits could leave you personally responsible for any remaining expenses, which may lead to significant out-of-pocket costs. Understanding bodily injury and property damage liability is essential for every car owner.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is vital for protecting yourself from financial losses in an accident with someone who lacks sufficient insurance.

This coverage not only safeguards your financial wellbeing but also provides peace of mind while driving. Imagine being in a collision with a driver who has minimal liability limits that don t cover your expenses. Having this coverage can save you from unexpected out-of-pocket costs.

Many insurers offer features like accident forgiveness, meaning your premium won t spike after your first accident. Adding this coverage to your policy can also lead to potential discounts, promoting responsible driving while ensuring your financial stability.

Factors that Affect Coverage Levels

Several factors can greatly influence your car insurance coverage levels. The cost of premiums varies based on your unique driver profile.

State requirements establish minimum coverage levels you must meet. The type and usage of your vehicle also play crucial roles in determining your coverage options.

Cost of Premiums

The cost of your premiums is a vital element of car insurance. It is shaped by several key factors, including the deductible you choose and the coverage limits you select, along with your overall insurance budget.

Your driving history carries considerable weight in this equation too. Previous claims and traffic violations can significantly influence your rates. For example, if you have a safe driving record, you re likely to enjoy lower premiums since insurers see you as a lesser risk to cover.

The type of vehicle you insure plays a crucial role as well. High-value or high-performance cars often come with higher costs due to expensive replacement parts and repair expenses.

Don t overlook the relationship between deductibles and premiums. A deductible is the amount you pay out of pocket before your insurance kicks in. Opting for a higher deductible typically results in lower monthly premiums, but it demands careful budgeting to ensure you have enough set aside for any potential claims.

State Requirements

State requirements for car insurance set the minimum coverage you must maintain to meet your financial responsibility. These requirements can vary significantly from one state to another.

Grasping these differences is essential, as failing to comply can result in penalties or leave you inadequately protected in the unfortunate event of an accident. Each state has its own laws and regulations, leading to varying levels of required liability, personal injury protection, and uninsured motorist coverage.

Insurance companies design policies that meet minimum standards and provide additional benefits to offer more comprehensive protection.

By exploring local options, you can discover policies tailored to your specific needs while remaining fully aware of your state s laws. This ultimately enables you to make informed decisions about your insurance coverage.

Vehicle Type and Usage

The type of vehicle you own and how you use it significantly influences the coverage options available to you. Different auto insurance types offer varying levels of protection based on these factors.

For example, a sports car that you enjoy for leisure might need a different coverage approach than a compact sedan you rely on for your daily commute. Families often prioritize comprehensive coverage for peace of mind, while single professionals may lean toward more affordable, minimal liability options.

This variability highlights the importance of consulting knowledgeable insurance agents who can assess your unique situation. These professionals help you identify the most suitable coverage levels tailored specifically to your vehicle’s characteristics.

This way, you can ensure that your policy not only aligns with your lifestyle but also provides adequate protection against potential risks.

Choosing the Right Coverage Level

Choosing the right coverage level is essential! Don t wait until it s too late take charge of your insurance today!

Selecting the appropriate coverage level for your car insurance involves a thoughtful assessment of your personal needs and budget. While it may seem complex, this step is crucial for ensuring you have enough coverage to protect you financially.

Evaluating Personal Needs and Budget

Evaluating your needs and budget is exciting! It helps you find the best coverage. This ensures that the policy you choose fits within your financial constraints while still meeting necessary coverage limits.

To effectively assess your driving frequency and associated risks, consider your daily commute distance, the number of trips you take each week, and the types of roads you typically navigate. Understanding your personal risk factors like your driving history or whether you have young drivers in your household can also play a significant role in shaping your insurance choices.

When you re gathering and analyzing insurance quotes, it s vital to compare not just the premium costs but also the specifics of each policy. Keep an eye out for features such as:

- Deductibles

- Liability coverage limits

- Added benefits like roadside assistance

This way, you can strike the perfect balance between affordability and adequate protection.

Frequently Asked Questions

What Are the Different Coverage Levels?

Different coverage levels refer to the kind of insurance you get. They define your protection and financial safety.

What Types of Coverage Are Usually Included?

Common types of coverage include liability, property damage, personal injury, and medical expenses. Each type offers different protection.

What Is Basic Coverage?

Basic coverage provides the minimum required insurance, such as liability coverage, to meet legal standards. It’s essential for legal driving.

What Is Comprehensive Coverage?

Comprehensive coverage offers broader protection. It covers damage to your property, theft, and various risks.

What’s the Difference Between Full Coverage and Minimum Coverage?

Full coverage includes both comprehensive and collision coverage. Minimum coverage meets only the legal requirements.

How Do I Find the Right Coverage Level?

To find the best coverage for you, assess your personal needs and risks. Consider the value of your assets and potential accidents.