Understanding Coverage for Self-Driving Cars

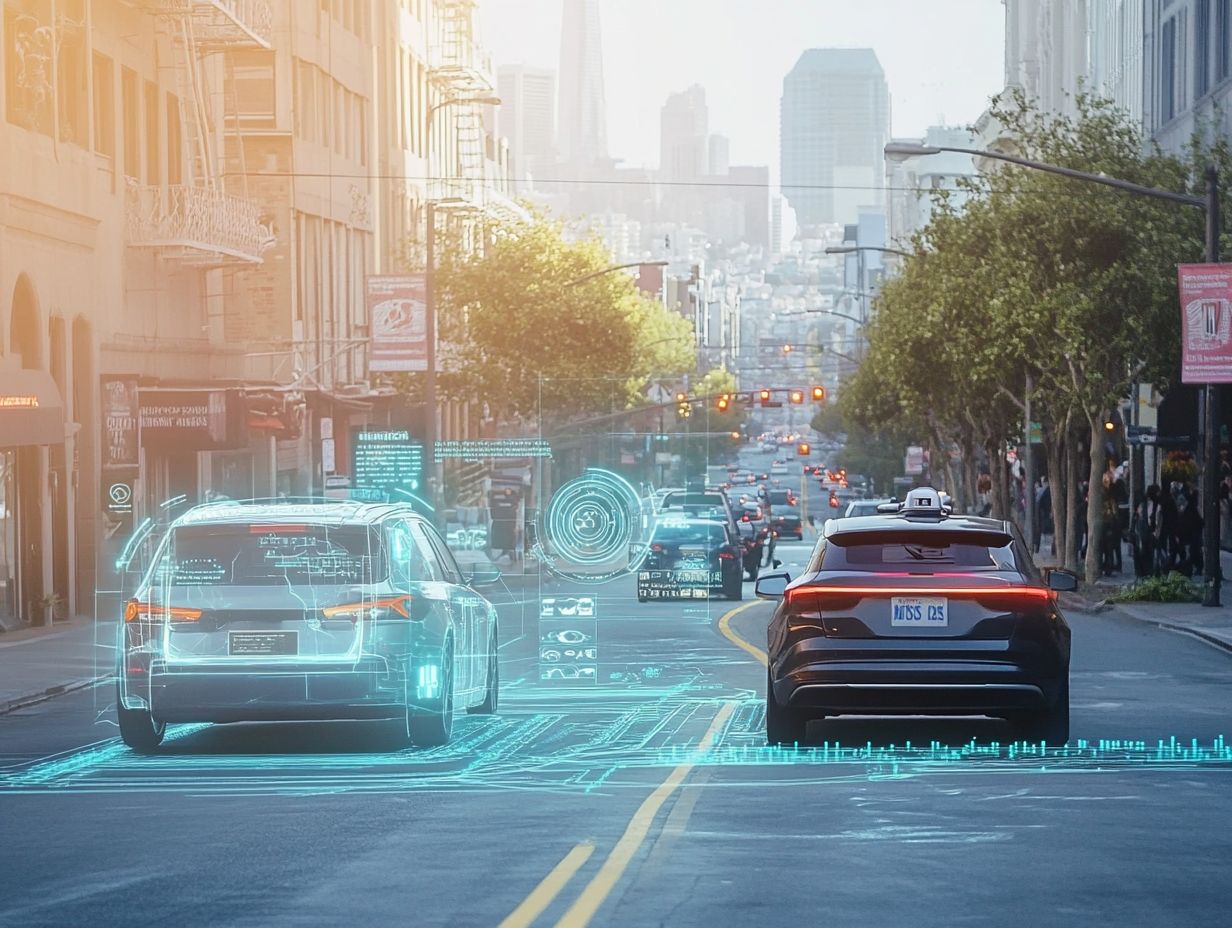

Self-driving cars have transitioned from futuristic fantasies to tangible realities on our roads. As these autonomous vehicles gain momentum, it s crucial to understand the types of insurance coverage they require.

This article unpacks the various insurance options available, including liability, collision, and comprehensive coverage. You ll also discover the factors that influence insurance rates, such as cutting-edge technology, safety features, and driver behavior.

While weighing the benefits and drawbacks of insuring these groundbreaking vehicles, consider how you can navigate the evolving landscape of automotive insurance.

Contents

Key Takeaways:

- Self-driving cars require specific types of coverage, such as liability, collision, and comprehensive, to protect against potential accidents and damages.

- The level of coverage is influenced by factors such as technology, safety features, driver behavior, and regulations.

- While coverage offers benefits like reduced accidents and increased safety, it can also lead to higher premiums and concerns about liability in accidents.

What are Self-Driving Cars?

Self-driving cars, or autonomous vehicles, represent a remarkable advancement in vehicle automation. They allow cars to operate independently across various levels defined by the Society of Automotive Engineers (SAE).

This revolutionary technology harnesses a blend of artificial intelligence, machine learning, and a suite of sensors including LiDAR (a technology that uses lasers to measure distances), radar, and cameras to perceive and interpret their surroundings effectively. The safety implications are significant; these vehicles have the potential to dramatically reduce accidents stemming from human error, which accounts for the majority of road incidents.

As companies like Ford and Audi explore different facets of driving automation, expect a wide array of features and reliability options. The future of transportation is not just about efficiency; it s about safety.

An ongoing evolution in technology calls for discussions surrounding regulations, ethical considerations, and necessary infrastructure changes. These discussions are crucial for the seamless integration of autonomous vehicles into our daily lives.

Types of Coverage for Self-Driving Cars

With the rise of self-driving cars, it s essential to recognize that the insurance industry must evolve as well. Ensuring that car insurance coverage adequately addresses the distinct risks tied to autonomous vehicles is vital.

This includes navigating liability questions and understanding manufacturers’ responsibility.

Liability Coverage

Liability coverage for self-driving cars is a pivotal aspect of the insurance industry. It addresses who bears responsibility for accidents involving autonomous vehicles. This raises essential questions about manufacturers’ liability and the requisite insurance standards.

Unlike traditional liability coverage, where human drivers are held accountable for their actions, the evolving landscape of autonomous transport shifts a portion of that responsibility toward vehicle manufacturers. This shift redefines risk assessment within the insurance sector and compels insurers to scrutinize the integrity of the technology that underpins these self-driving cars, including understanding coverage for car sharing programs.

As algorithms and software updates increasingly dictate vehicle behavior, determining liability becomes complex. This highlights the need for clearer regulations. The implications of this shift are extensive, prompting ongoing discussions about what constitutes appropriate coverage as the distinction between driver and machine continues to blur.

Collision Coverage

Collision coverage is a key part of car insurance for autonomous vehicles. It protects you from damages resulting from accidents, whether the car is in autonomous mode or being driven manually.

This coverage is crucial, especially with rapidly advancing technology that allows vehicles to navigate with minimal human input. Understanding the future of auto insurance coverage is essential for anyone owning or operating vehicles with varying levels of automation.

Consider fully autonomous cars. They use advanced onboard sensors and computer programs to navigate and avoid collisions. However, they face unique challenges, like interpreting complex driving environments. Insurers navigate complex issues in determining fault in accidents involving automated systems, raising questions about liability and how premiums are adjusted fairly.

Robust collision coverage protects you as a vehicle owner and fosters trust in an ever-evolving industry!

Comprehensive Coverage

Comprehensive coverage is an important layer of insurance for your autonomous vehicle. It safeguards you against various non-collision-related incidents, such as theft, vandalism, and natural disasters.

As technology progresses, the need for specialized insurance solutions becomes clear. Your automated vehicle navigates complex environments, facing unique risks that traditional cars don’t encounter.

For instance, if your autonomous car is parked in a public area and is vandalized, comprehensive coverage protects you from financial losses. With increasing concerns about data privacy and cyber threats, insuring against risks like hacking is also crucial.

Want peace of mind? This insurance not only protects your vehicle but also allows you to embrace the future of transportation!

Factors Affecting Coverage for Self-Driving Cars

Several factors influence coverage for self-driving cars. These include technology advancements, safety features built into vehicles, insurance requirements, and the growing cybersecurity risks associated with autonomous vehicles. For a deeper insight, consider checking out understanding coverage for unconventional vehicles.

Technology and Safety Features

The technology and safety features in self-driving cars significantly affect your insurance coverage. These advancements enhance safety and reduce risks associated with autonomous vehicles.

Think about the sophisticated sensors, cameras, and artificial intelligence that allow these vehicles to detect hazards, assess road conditions, and make quick decisions. This enhanced safety dramatically lowers the likelihood of accidents, influencing how insurers assess risk.

Insurers may offer reduced premiums due to advanced safety technologies, adjusting policies to reflect the smarter driving patterns of self-driving cars. You can expect a transformation in how traditional coverage models are applied, leading to competitive pricing and better terms for your insurance!

Driver Behavior and Regulations

Driver behavior and existing regulations are important in shaping the insurance landscape for autonomous vehicles, influencing how these vehicles are perceived in terms of risk and liability.

As technology advances and pushes the boundaries of autonomous driving, it becomes essential to understand how human actions intertwine with regulatory measures. Regulatory frameworks are evolving to tackle the unique challenges these innovations present. Understanding how driver interaction or the absence of it affects overall safety is crucial.

In response, insurance providers are adjusting their policies to reflect the potential decrease in human error, a critical factor in the process of assessing risk. By taking into account both behavioral patterns and legal stipulations, insurers can create more tailored solutions, easing your journey into a future where autonomous vehicles are common on the roads.

Benefits and Drawbacks of Coverage for Autonomous Vehicles

Evaluating the benefits and drawbacks of coverage for autonomous vehicles is crucial for you as a consumer and for the insurance industry as a whole. This assessment plays a significant role in guiding your decision-making process, especially as the market for autonomous vehicles continues to expand.

Pros of Coverage

The advantages of coverage for autonomous vehicles are compelling: you benefit from a reduced risk of accidents, lower insurance premiums, and the potential for enhanced safety through the sophisticated technologies employed in these vehicles.

As the landscape of autonomous driving technology continues to advance, you not only gain peace of mind but also enjoy significant financial savings. Insurance companies are likely to see a decline in claims, which could lead to further reductions in premiums. This ultimately encourages a broader embrace of these innovative vehicles.

The data collected from autonomous vehicles can refine risk assessments, allowing for more tailored coverage options. This creates a situation that benefits both the insurance sector and you as a driver by delivering greater protection and affordability. With fewer accidents on the road, societal risks diminish, paving the way for a more secure future in transportation.

Cons of Coverage

The drawbacks of coverage for autonomous vehicles can include initially higher premiums and ever-changing regulations. Additionally, there is uncertainty surrounding liability in accidents involving these vehicles.

As this technology advances, insurers may struggle with accurately assessing risk. This could lead to fluctuations in premium rates that leave you feeling unsettled. Given that autonomous vehicles rely on sophisticated algorithms and artificial intelligence, the question of accountability in the event of an accident becomes quite complex.

This ambiguity complicates claims processes and could spark disputes over responsibility will it be the manufacturer, the software developer, or you, the car owner? With regulations evolving, you might also encounter a patchwork of rules that differ by region, making it increasingly challenging to navigate your coverage needs effectively.

Frequently Asked Questions

What is self-driving car coverage?

Self-driving car coverage is insurance designed to protect you and your vehicle in case of an accident with an autonomous car, and it’s important to understand coverage for transportation companies when considering your options.

Who needs self-driving car coverage?

Anyone who owns or operates an autonomous vehicle should have self-driving car coverage. This includes companies that use these vehicles for transportation or delivery services.

What does self-driving car coverage typically cover?

Self-driving car coverage typically covers damages and injuries caused by the autonomous vehicle, as well as liability for any accidents or incidents involving the vehicle, including coverage for uninsured vehicles.

Get ready for a revolution in transportation! Explore your options for self-driving car insurance today.

Are there different types of coverage for self-driving cars?

Yes, there are various types of coverage for self-driving cars. These include liability coverage, which protects you if you cause an accident; collision coverage, which pays for damage to your car in an accident; and comprehensive coverage, which covers non-collision incidents like theft or weather damage. For a deeper understanding, refer to understanding the role of coverage in accidents. Each type of coverage protects you in different ways.

Do self-driving cars require special insurance?

Yes! Self-driving cars need specific insurance policies tailored to their unique risks. Traditional auto insurance often doesn t provide enough protection for these advanced vehicles.

How is self-driving car coverage priced?

The price of insurance for self-driving cars varies based on several factors, such as the type of coverage and the risk level of the vehicle. As self-driving technology rapidly advances, it s crucial to secure the right coverage, as costs may also change.