What is Personal Property Coverage in Auto Insurance?

Personal Property Coverage is a vital component of your auto insurance, designed to protect your belongings in the unfortunate event of an accident or theft.

By grasping its definition, purpose, and the specifics of what it covers, you can better safeguard your valuable items. This article delves into the types of personal property included, as well as the limits and exclusions you should be aware of. It also offers guidance on how to file a claim effectively.

It also addresses whether this coverage is necessary for you and provides tips for selecting the ideal policy. Prepare to make informed decisions about protecting your personal property!

Contents

- Key Takeaways:

- Understanding Personal Property Coverage

- What is Covered by Personal Property Coverage?

- Limits and Exclusions

- How Personal Property Coverage Works

- Do You Need Personal Property Coverage?

- Tips for Choosing Personal Property Coverage

- Frequently Asked Questions

- What is Personal Property Coverage in Auto Insurance?

- What does Personal Property Coverage cover in Auto Insurance?

- Is Personal Property Coverage included in all Auto Insurance policies?

- How much Personal Property Coverage do I need in my Auto Insurance policy?

- What is the difference between Personal Property Coverage and Personal Injury Protection in Auto Insurance?

- Does Personal Property Coverage cover items left in a rental car?

Key Takeaways:

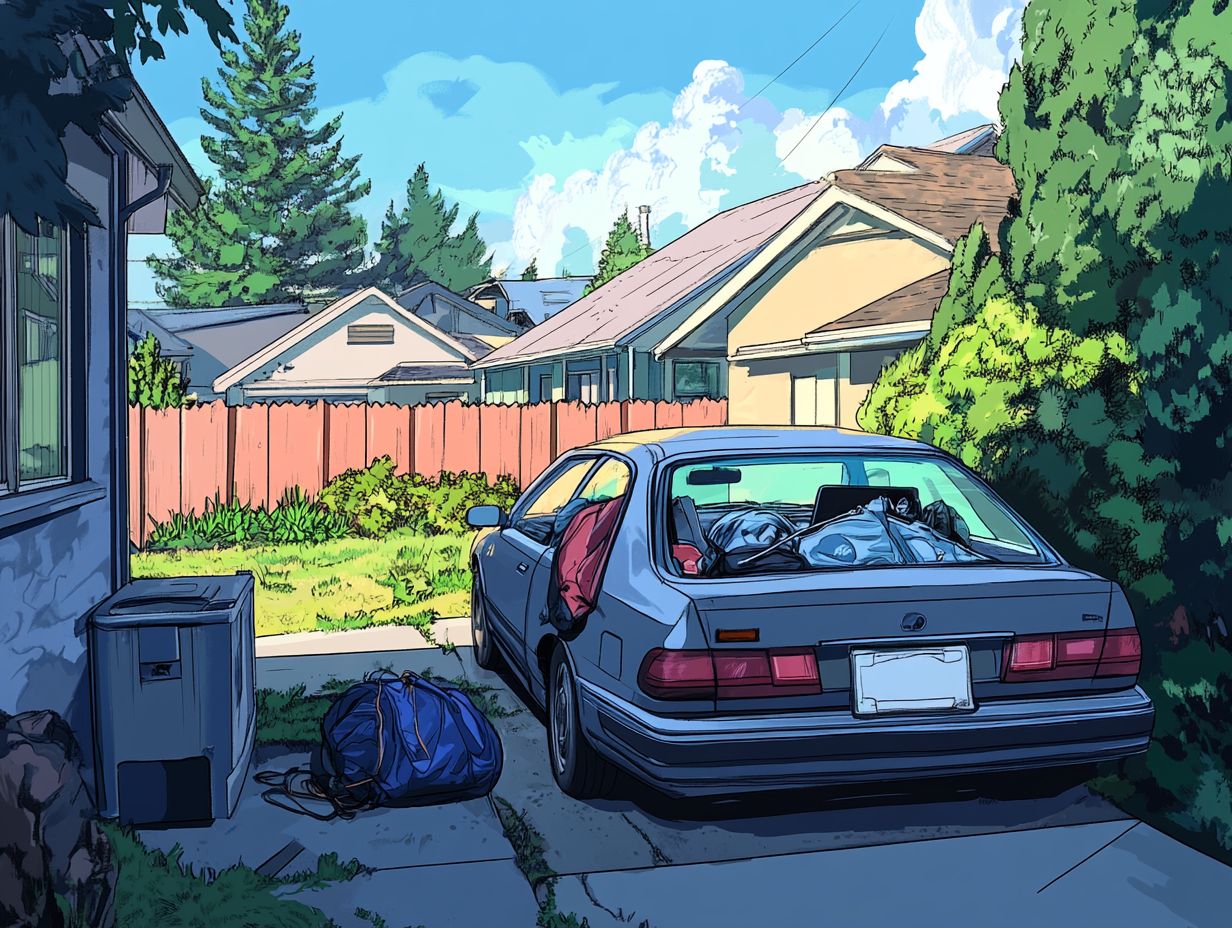

- Personal property coverage is a component of auto insurance that protects your belongings inside your vehicle in case of theft or damage.

- This coverage includes items such as electronic devices, clothing, and luggage, but may have limits and exclusions depending on your policy.

- Consider your personal belongings and their value before deciding if personal property coverage is necessary for you. Carefully review policy details to ensure adequate coverage.

Understanding Personal Property Coverage

Grasping the nuances of personal property coverage is vital for shielding your belongings from unexpected events like theft, accidents, or damage. This form of insurance offers robust protection for your personal items, encompassing everything from everyday belongings to valuable items, granting you financial security in the face of loss and property damage.

Whether you own a condo, rent an apartment, or run a business, understanding your coverage options and the invaluable role of insurance agents is key. With this knowledge, you can confidently protect your belongings.

Definition and Purpose

Personal property coverage is an important part of your insurance plan, designed to shield your belongings from unexpected events like theft or damage. This type of coverage offers you financial protection when you need it most.

It becomes especially vital when you consider the value of items such as electronics, furniture, clothing, and other personal effects. Picture this: if you were to suffer a burglary or a fire that resulted in the loss of your possessions, personal property coverage could significantly ease the financial strain by compensating you for what you’ve lost or what has been damaged.

It typically even covers items that you might temporarily remove from your home, like a laptop swiped from a caf or jewelry misplaced while traveling. Grasping the details of this coverage is crucial for ensuring that your assets are well-protected against unforeseen circumstances.

What is Covered by Personal Property Coverage?

Personal property coverage includes a wide array of items and situations, offering you protection through homeowners insurance, renters insurance, and condo insurance policies. This coverage is specifically designed to shield your personal belongings, including both everyday items and high-value possessions, from unforeseen events like theft and damage.

Types of Personal Property Covered

Personal property coverage encompasses a variety of items, including your personal belongings, electronics, furniture, and equipment, safeguarding you against theft, damage, and loss.

The extent of this coverage can vary significantly depending on the type of policy you choose. For example, a homeowners policy typically offers broad protection for a wide range of personal property, covering everything from appliances and jewelry to outdoor gear and artwork.

In contrast, renters insurance focuses primarily on your belongings within the rented space. While it usually includes furniture and personal items, you may need to consider add-ons for high-value items like collectibles or electronics.

Condo insurance serves a dual purpose by protecting both your personal property and the specific items within the walls of your unit, while the master policy held by your condo association typically covers common areas. Understanding the nuances of each policy is crucial to ensure that you have adequate protection for what matters most to you.

Limits and Exclusions

Understanding the limits and exclusions of your property coverage is crucial. Without this knowledge, you could lose out on protecting your belongings when you need it most!

Each insurance policy has its own specific coverage limits, determining the maximum compensation you can receive for claims involving theft, damage, or loss. Additionally, exclusions can differ from one policy to another and may significantly influence how the claims process unfolds.

Understanding Coverage Limits and Exclusions

Coverage limits and exclusions are essential aspects of personal property coverage, shaping the extent and boundaries of the financial protection your insurance policy offers. Understanding these components can profoundly influence your claims process and your overall financial well-being.

For example, if your coverage limit falls short of covering the full value of your lost or damaged belongings, you could be faced with significant out-of-pocket expenses. Many personal property policies include common exclusions, such as damage caused by natural disasters like floods or earthquakes, leaving you vulnerable during critical moments.

Some exclusions apply to high-value items, such as jewelry or electronics. These often have lower coverage limits than you might expect. Being aware of these limitations is crucial for effective risk management, ensuring your financial safety in the unfortunate event of a loss.

How Personal Property Coverage Works

Personal property coverage functions through a clear claims process, expertly designed to deliver compensation for eligible losses. When an insured event (an event that’s covered by your policy, like theft or damage) occurs, you need to file an insurance claim that outlines the incident and the personal belongings impacted.

Following this, the insurance company will assess your claim and determine compensation based on your policy’s coverage limits and the amount you pay before insurance kicks in.

Filing a Claim and Receiving Compensation

Filing a claim for personal property coverage typically requires you to submit detailed documentation of the loss, including the specifics of the incident and a thorough inventory of the affected items to ensure you receive proper compensation.

In this process, it’s crucial for you to fully understand your deductibles and their impact on the overall settlement. Keeping a meticulous inventory of your personal belongings not only streamlines the claims process but also helps in accurately assessing the value of lost items. Gathering receipts, photographs, and witness statements can significantly strengthen your claim, making it harder for insurers to dismiss or undervalue your reported losses.

By diligently following each step and maintaining comprehensive records, you can greatly enhance your chances of securing the appropriate compensation for your losses.

Do You Need Personal Property Coverage?

Determining whether you need personal property coverage calls for a thoughtful evaluation of several key factors, including the value of your belongings and the level of financial protection you desire.

By assessing your potential risks for theft, damage, or loss of personal items, you can make an informed decision about whether investing in insurance coverage is essential for safeguarding your valuable possessions.

Factors to Consider

When contemplating personal property coverage, several important factors come into play. You should assess the total value of your belongings, evaluate your lifestyle choices, and consider the potential risks related to theft or damage.

For instance, if you’re residing in an urban environment, you may face heightened risks of theft due to the denser population and increased foot traffic. In such cases, comprehensive coverage becomes especially crucial. On the flip side, if you’re in a rural area, you might encounter fewer property crime incidents; however, the threat of natural disasters like floods or wildfires could be more pronounced, requiring a different perspective on your coverage options.

Additionally, lifestyle choices such as frequent traveling can leave valuable items unattended, further shaping the type of protection you should contemplate to effectively safeguard your personal property.

Evaluate your belongings today to see if personal property coverage is right for you! Don t leave your valuables at risk.

In conclusion, understanding your personal property coverage, its limits, and exclusions is vital for protecting your valued possessions. Be proactive review your policy, assess your needs, and seek guidance if necessary.

Tips for Choosing Personal Property Coverage

Selecting the ideal personal property coverage demands thoughtful examination of various insurance policies and coverage options to pinpoint what best suits your needs.

Key considerations include understanding coverage limits, evaluating insurance riders for high-value items, and obtaining appraisals to ensure your belongings are well protected.

Every step is important for protecting your assets.

Key Features to Seek in Your Auto Insurance Policy

When evaluating an insurance policy for personal property coverage, consider several essential aspects, including coverage options, exclusions, and the claims process. Make sure your belongings are well protected!

Take the time to scrutinize coverage limits to determine if they align with the overall value of your possessions. Understanding deductibles the amount you pay out of pocket before your insurance kicks in is equally important. Opting for a higher deductible may lower your premiums but could impact your out-of-pocket expenses when filing a claim.

Also, think about adding insurance riders for high-value items, such as jewelry or electronics. These can provide extra peace of mind, ensuring that your treasured possessions are fully covered.

Finally, an efficient claims process can significantly influence the overall effectiveness of your policy. A streamlined experience in filing a claim and receiving compensation can truly make all the difference when dealing with potential loss.

Frequently Asked Questions

What is Personal Property Coverage in Auto Insurance?

Personal Property Coverage in Auto Insurance refers to the coverage for items stolen or damaged while inside a vehicle. This can include electronics, clothing, and other personal belongings.

What does Personal Property Coverage cover in Auto Insurance?

Personal Property Coverage in Auto Insurance typically covers items not permanently attached to the vehicle, such as cell phones, laptops, and clothing. It may also cover items attached to the vehicle, like a bike rack or trailer.

Is Personal Property Coverage included in all Auto Insurance policies?

No, Personal Property Coverage is not automatically included in all Auto Insurance policies. It is usually an optional coverage that can be added for an additional cost.

How much Personal Property Coverage do I need in my Auto Insurance policy?

The amount of Personal Property Coverage needed in your Auto Insurance policy will depend on the value of the items you typically carry in your vehicle. Review your coverage limits to ensure they are sufficient to cover the cost of your personal belongings.

What is the difference between Personal Property Coverage and Personal Injury Protection in Auto Insurance?

Personal Property Coverage in Auto Insurance covers the cost of personal belongings in the event of theft or damage. In contrast, Personal Injury Protection covers medical expenses for injuries sustained in a car accident, regardless of fault.

Does Personal Property Coverage cover items left in a rental car?

It depends on the specific terms of your policy. Some Auto Insurance policies may cover items left in a rental car, but it’s important to check with your insurance provider to confirm your coverage and any limitations.

Take action now to ensure your personal belongings are protected!